Banking made easy

with excellent innovation

Fynhaus is a banking software solution provider based in Amsterdam, Netherlands.

We are specialized in RegTech, specifically in the fields of regulatory compliance, fraud detection, and financial transaction messaging.

Our Solutions

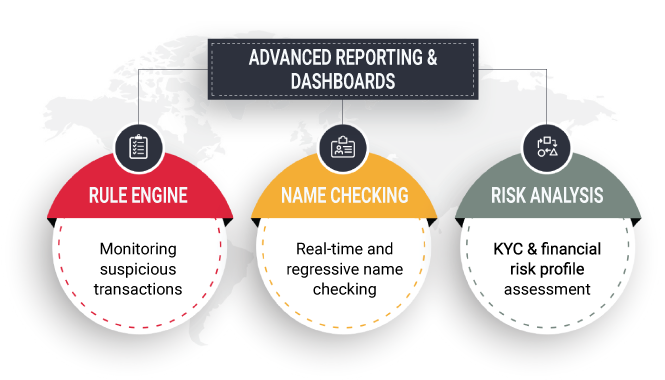

End-to-End Anti Money Laundering

FORTE™

In order to combat money laundering, banks will go through a series of customer and transaction verifications:

- Real-time transaction analysis and pattern detection over longer durations

- Name checking of the client’s name in several sanction lists (e.g. OFAC, UK Treasury Consolidated List, UN, and FATF)

- Risk-based classification: a method which combines both elements from the KYC category (Know Your Customer) and financial category

For the transaction analysis and risk-based classification, the bank has a high degree of discretion in adapting the requirements. Solutions usually have a standard part, and a part that is adapted to specific configuration needs. The advantage for the banks is improving their compliance capabilities, as well as strengthen their reputation and global standing. It is often a requirement by central banks in order to be present on the global banking transactional grid.

FORTE™ provides a capability that exceeds the competition in terms of modularity, implementation speed, data-mining complexity, and flexibility.

Additionally, the Name Checking module is available to be sold as a standalone product.

Advanced SWIFT gpi Tracking

TEMPO™

Banks are adopting a new payment traceability standard from SWIFT. The Global Payment Initiative (gpi) is mandatory for all financial institutions on the SWIFT network. It allows for:

- Faster and more convenient cross-border payments

- Higher transparency and accurate traceability of payments

- Better service to clients with detailed breakdown of charges and fees

The industry is currently in a transition period of switching to the gpi compliance for banks. While many are adopting a manual option, the need for an automated software solution is very high.

Our offering comes in three variants to suit institutions of different sizes and needs. This ranges from strict compliance with essential features up to full advanced parametrization.

HIGH ADAPTABILITY

TEMPO™ is highly compatible with all bank protocols, making it ready for any transaction messaging system. It is flexible in configuration for all business rules without disruption of banking operations.

COMPLETE TRACEABILITY

Our solution ensures full processing of messages and update information. It allows for easier auditing and tracking, giving higher visibility from a macro level to specific details.

FULL COMPLIANCE

Our software is designed in complete accordance with the SWIFT gpi Standard Release 2021. In this way, financial institutions adopting our platform will meet the requirements set by SWIFT.

FUTURE-PROOF

TEMPO™ is future-proof by design. The bank is ready for updates without the need re-deploy the software. Our offering is non-restrictive, allowing it to be used alongside third party applications.

Modular ISO 20022 Transformer

LEGATO™

Banking transactions currently rely on messaging protocols that are called SWIFT MT standards, following ISO 15022. A new XML-based standard (CBPR+ MX) is being introduced, and is based on the ISO 20022:

- It provides more transaction information and data sets, leading to better AML control and regulatory reporting

- It includes multiple transactions in one file, simplifying the messaging process

- It is easier to read, write, and use

LEGATO™ automatically translates any format (including MT) to its MX counterpart and vice versa, with data validation and full traceability. It is pre-loaded with all the required transformation mappings, allowing for fast deployment.

Efficient FATCA & CRS Reporting

ALTO™

Many banks still rely on manual methods to generate the regulatory FATCA and CRS reports. This becomes unrealistic for institutions with a large number of account holders, requiring more automated solutions. The advantages of ALTO™ include:

- Comprehensive A-Z solution from detection, to case management and report generation, making banks efficient with faster turnaround times

- Rule-based analysis providing preset and customizable detection mechanisms

- Visual and easy-to-use reporting engine

- Secure encryption and data transfer

About us

Fynhaus is a banking software solution provider based in Amsterdam, Netherlands. We are specialized in RegTech, specifically in the fields of regulatory compliance, fraud detection, and financial transaction messaging.

With over three decades of experience in the domain, our solutions are well suited for the specific needs of financial institutions. We provide a seamless transition into modern banking standards and requirements, without disrupting the existing processes.

Our passion for quality is the main driver in our offerings, and we actively aim to exceed the expectations of our clients.

Our Values

We embrace strong inner values of integrity, excellence and transparency. By putting our customers first, we maintain a flexible and forward-thinking mindset. Our ultimate goal is to make banking easy with excellent innovation.

Selected Partners

Media & Announcements

Fynhaus to implement payment transfer automation with Investment Bank of Iraq

Amsterdam, March 19, 2024 – Fynhaus is thrilled to announce its partnership with Investment Bank of Iraq for the transfer information automation solution. Together in collaboration with Turnkey Systems and MDSL, Fynhaus’ LEGATO™ solution will help the acceleration of the

Ashur International Bank selects Fynhaus for advanced AML solution

Amsterdam, August 23, 2023 – Fynhaus is delighted to announce its esteemed partnership with Ashur International Bank for the enhancement of their Anti-Money Laundering (AML) infrastructure. In collaboration with Turnkey Systems and MDSL, Fynhaus will provide a cutting-edge compliance system,

Fynhaus is a RegTech100 company

Amsterdam, December 7, 2022 – With great delight, Fynhaus has been chosen for the first time to be represented in the RegTech100 listing for 2023, issued by Fintech Global. This list is described as the world’s most innovative RegTech companies

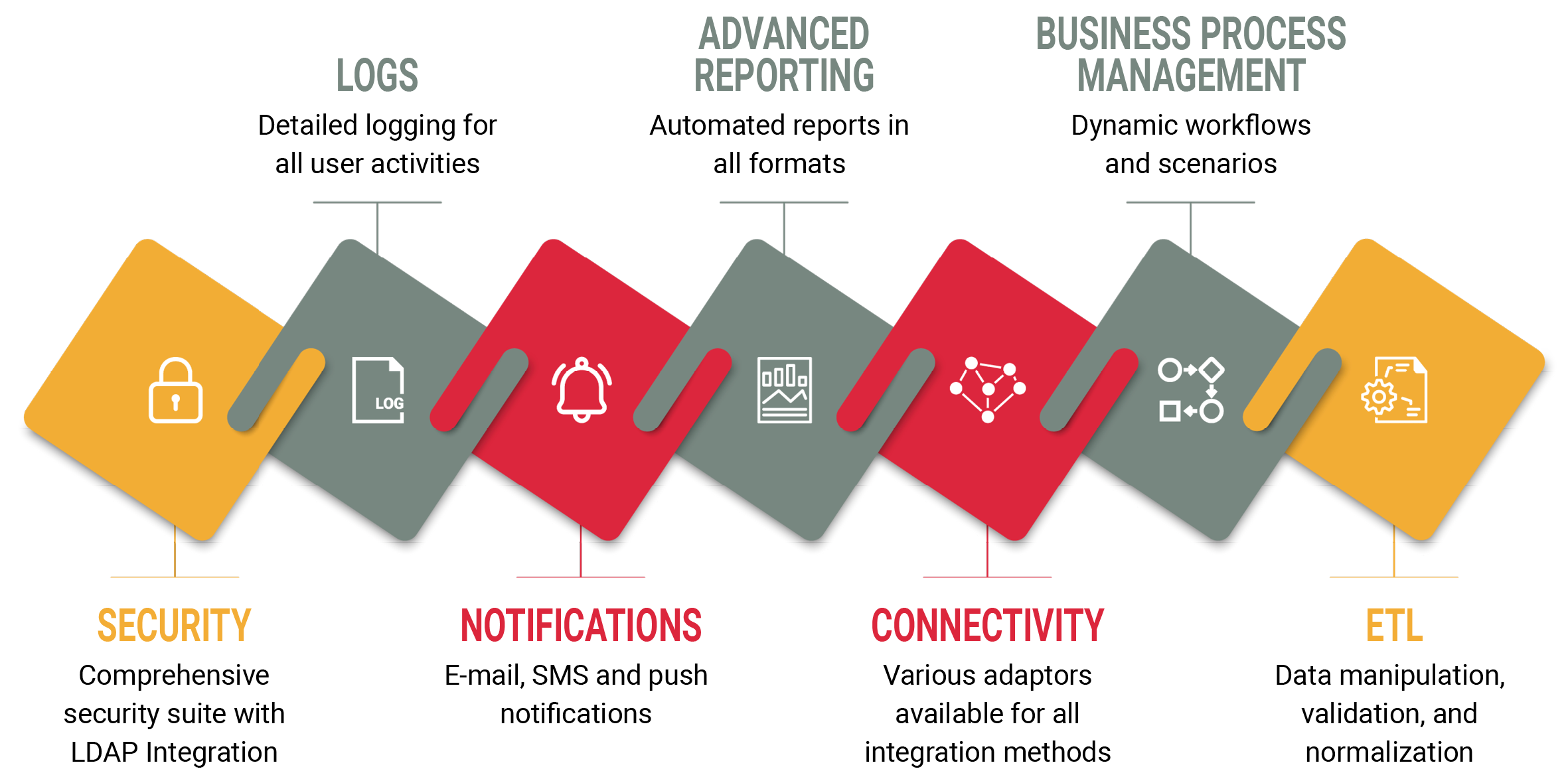

Our Platform

State-of-the-art Architecture

All of the fynhaus solutions rely on a common core foundation, ranging from basic security requirements up until advanced features. These include dynamic business processes, complex data manipulation, filtering, and transformation.

Our enterprise-ready architecture allows for hosting multiple institutions within one hardware infrastructure. This in turn optimizes on the bank’s overall costs, and requires less maintenance and manual intervention.

English and French languages are available by default. The system is designed to accomodate the inclusion of any additional language as necessary. It is then possible to toggle between all configured languages in the system.

KEY FEATURES

- Data Manipulation & Filtering Bank data is loaded via scheduler. It is then analyzed, validated for integrity, substituted, and normalized. Rule-based detection and filtering is utilized for case management and reporting purposes

- Business Process Management Tight integration with the Camunda open source BPM engine which is used for multi-level workflows, and for complex scenarios

- Advanced Reporting Dynamic reports can be generated on demand or scheduled, leveraging all available connectors, and generating reports in all formats

- Notifications E-mail, SMS and push notifications are an integral part of the system for alerting clients and employees, as well as report delivery and task escalation

Security Features

Understanding the criticality of smooth banking

operations, security plays an integral role in all of the

solutions in our portfolio.

Data Archiving

Periodic archiving of operational data to a secondary database.

Multi-Factor Authentication

Dynamic workflow for all critical operation.

GDPR Compliance

Stored information is encrypted and is compliant to EU GDPR.

LDAP Integration

Lightweight Directory Access Protocol for unified authentication and authorization.

Security Logs

Detailed comprehensive security logs for all user activities.

FYNConnect™

FYNConnect™ is our embedded plug-in layer which is designed for ease of communication through a variety of protocols. This allows for easy integration with the core banking solution and 3rd party providers.

FYNConnect™ is unique in its flexibility and deployment speed in any environment.

Our communication protocols include:

- UNC folders & files

- Database tables / views

- FTP / SFTP / FTPS

- SOAP / REST APIs

- MQ / JMS messaging

- HTTP / HTTPS

- Custom adapters for specific bank needs

Contact us

- +31 6 29 38 93 96

- info@fynhaus.com

- Fynhaus on Linkedin

-

Fynhaus B.V.

Singel 542

1017 AZ Amsterdam

Netherlands